Bonds

Fixed coupon Bond

The intrinsic value of a bond in the present value of the future coupon and redemption amount discounted at the required rate of return. If he market price is lower/higher, the bond is under/over priced & should be purchased & short sold.

A bond will be redeemed equally at the end of 4th & 5th year at a premium of 10%.

Risk free real rate = 5% p.a.

Expected inflation = 4%

Risk premium = 6%

Current market price =Rs 4,950

Find out the intrinsic value and advice the investor

Bond yields:

Traders in the bond mkt generally compares bonds in terms of yield rather than IV, There are three measure of yield

- Coupon Rate (CR): The annual interest rate on a bond.

- Current yield (CY): It is also not representative as it ignore the CF beyond the current period

- Yield to maturity (YTM): it is the IRR of the bond

Relationship of the above measure of yield:

For bonds trading at par: YTM=CY=CR

For bond trading at discount: YTM>CY>CR

For bond trading at Premium: YTM<CY<CR

From a computational perspective, YTM is given by outflow=inflow

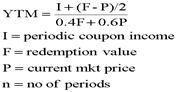

However, in case of plain vanilla bond (i.e. bond with constant coupon & 1 shot i.e. bullet redemption) YTM is allowed to be computed by a shortcut approximate formulae given by :

: Find out the YTM of a 10% Rs 5000 FV bonds, maturity 5 years & presently trading at 4720. If the ROR is 13%p.a. should the bond be purchased

Case 1: If income tax rate is 30% and capital gains tax is 10%. Find out the post tax YTM of the bond

Case 2: Ignore taxation and recomputed the YTM of the bond given that the bond would be redeemed in 2 equal installments At the end of 4th & 5th year.

Case 3: Now consider semi annual coupon payment and one shot redemption. Find the Annualized current yield & YTM.

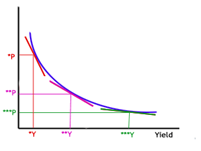

PRICE YIELD relationship

There is negative relationship between bond price & interest rate, Thus if yield rises/falls, bond price is expected to fall/rise. However price yield relationship is not linear. Instead it is convex to the origin as shown :

Thus the % increase in bonds prices from given decrease in YTM is higher than % decrease in bond price than the same increase in YTM. This favourable property is positive convexity

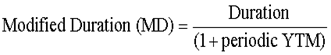

In order to quantify bond volatility i.e. sensitivity of bond w.r.t interest rate, we draw a tangent to the price yield curve. The slope of the tangent is the measure of volatility.

Bond volatility (depends on maturity) i.e. the slope of the tangent is known as Modified duration (MD). Thus if MD is 6.2%, it means that for a 1% change in interest rate bond price is expected to change by 6.2% in the opposite direction ignoring convexity

Computation of bond volatility:

Duration is the average holding period where all CF from the bond are deemed to have received one shot

So duration= ∑wx/ ∑w; where ‘x’ refers to periods of CFs received ‘w’ is the PV of the cash flow discounted

Consider a 14% , Rs1000 (FV), 5yr bond presently trading at Rs942. compute bond volatility & expected intrinsic price, if interest rate were to fall by 60 basis point

Bond portfolio management:

| Passive | Active |

| Believe that the market are efficient i.e. all security are correctly priced | Believe that the market are inefficient & there are pocket of mispricing |

| Invest in a diversified portfolio to replicate a benchmark index | Invest in a non-diversified portfolio of bonds which are supposedly underpriced |

| Does not engage in interest rate anticipation | Use interest rate anticipation strategies |

| Low portfolio churning leading to lower transaction cost | Low portfolio churning leading to lower transaction cost |

Interest rate anticipation strategies:

This strategies involve change in portfolio duration (DP) in anticipation of a change in interest rate.

DP is the weighted average of the bonds comprising the portfolio. The strategies are:

If interest rates are expected to fall, bond prices are expected to rise. Since higher duration bonds are more volatile than lower duration bonds, the fund manager should increase DP by shifting funds from lower duration bonds to higher duration bonds

If interest rates are expected to rise, bond prices are expected to fall. Since higher duration bonds are more volatile than lower duration bonds, the fund manager should decrease DP by shifting funds from higher duration bonds to lower duration bonds

IMMUNISATION:

Interest rate risk refers to the risk of not realizing the promised YTM due to changes in interest rate:

Interest rate risk has two components

Re investment risk= compounding exercise

Price risk discounting exercise

YTM is based on two unrealistic assumptions

The intermediate CF are assumed to have been reinvested at YTM yield

The bond is assumed to be held till maturity

The first assumption of the YTM seems to kill reinvestment risk & the second assumption kills the price risks. However, in rectify interest rate keep on changing & the investor have to suffer both the risk

Since reinvestment risk & price risks are acting in opposite direction, they tend to cancel out each other at a particular point of time i.e. Macaulay's Duration (D). Duration may now been defined as that holding period where re investment effect & price effect cancel out each other such that the investor is immunized from changes in interest rates. An investor should always buy a bond or a portfolio of bonds whose duration is equal to his investment horizon

Floating rate bond:

This bond doesn’t have a fixed coupon rate, instead there would be a coupon formulae which relates the coupon rate with some market reference rate such as prime lending rate (PLR), London inter bank rate (LIBOR), MIBOR etc

The investor/issuer of a floating rate bond expects interest rate to rise or fall. In order to protect themselves against adverse fluctuation in interest rate, a floating rate bond would generally be accompanied with a cap and a floor features. A combination of cap & floor is know as collar

Consider a 5 yr, Rs 1000 FV floating rate bond a coupon of 200 B.P over PLR. Presently PLR is 9%. A forecast of PLR is likely to prevail at the beginning of each of year for next 4 years is shown below:

YIELD CURVE STRATEGIES:

Yield curve is a graphical representation of the term structure of interest rates. The term structure of interest rates is a relationship between YTM & maturity , other factors remaining constant between

The yield curve can have any shape. The popular shapes of the yield curves & their interpretations are as follows

Upward sloping yield curve: Interest rate are expected to rise. So the investor should choose a short term bond

Downward sloping yield curve: Interest rate are expected to fall. So the investor should choose a long term bond

Flat yield curve: Interest rate are not expected to change. So the investor should choose bond with highest YTM irrespective of maturity long term bond

Spot rate & forward rates:

Spot interest rate is the interest rate applicable for borrowing/investment today and is denoted by ron. On the other hand forward interest rate is the interest rate applicable for borrowing/investment to take place later on & denoted by ft1t2(i.e. interest rate applicable for borrowing/investment after t1 yrs for t2-t1 yrs

To prevent arbitrage, a certain relationship must hold good between spot interest rate & forward interest rate

Therefore, (1+ro2)2= (1+ro1)(1+f12)

Ro2=[(1+ro1)(1+f12)]1/2-1

Bond valuation:

Value of Semi-annual interest bond

Value of floating rate bond

Bond with changing yield rates

Value of optionally convertible debenture/bonds

Equity valuation:

Equity valuation is highly subjective and judgmental exercise recording and analysis of the economy industry and company. There are several methods which may be classified as follows:

- Relative: based on the price multiple

- absolute : dividend discount model (minority perspective ) & free cash flow approach (control perspective)

- residual : using the concept of EVA

Dividend discount model :

Intrinsic value of this year is the TV of the expected future dividends discounted at the client rate of return

IV= D1/(1+Re)+D2/(1+Re)2+……+

so there are two inputs in the valuation process .

Equity capitalization rate

Forecast of futures dividend

As per CAPM Investors holds diversified portfolios and he requires compensation for bearing only systematic risks captured by B . B refers to the sensitivity of stock’s return to the mkt returns. Thus if a 10% change in market returns brings about 15% change in the stock’s return, then B is 1.5

Required rate of per CAPM: Rf+ B( Rm- Rf)

There are three methods of dividend forecast

No Growth

Constant growth

Multiple growth

Method I: g can be taken as average of the past after suitably adjusting for any bonus issue or share split. The averaging may be done using simple average or compound average

Method II: Sustainable growth rate is often deemed as the growth that a firm can achieve using only internal funds. Thus g= retention ratio ROE

Methods III: Multiple growth DDM

Free Cash flow approach

An acquirer is not interested in the dividend policy of the target, instead he is concern with the CF generating ability of the target. Hence FCFA is preferred over DDM in case of Mergers and Acquisitions.

There are 2 types of free cash flow for the firm (FCFF) and free cash flow for the equity (FCFE) in general FCF refers CF net of investments.

FCFF Approach

Value of the firm is equal to PV of FCFF discounted at Ke. Thus value of equity is equal to value of the firm – market value of debt+ market value of non trade investments.

Residual Approach of Valuation

Residual income or EVA refers to post Tax earnings generated by firm over and above what is required by share holders , therefore EVA = PAT – (KE x net worth) or (ROE – KE ) x Net worth or NOPLAT – (KC x invested capital).

EVA is a source of value creation and is reflective of firm investing in positive NPV projects. We define market value added (MVA) as the present value of future EVA so value of firm equity net worth + MVA or value of the firm = invested capital + MVA.

Relative method of valuation

Relative valuation involves valuing a firm on the basis of how similar firms are valued. It requires the use of price multiples . Price to earning ratio, price to sales ratio, price to book value ratio. The challenges to relative valuation lies in computing the justified price multiples. This can be done by following method.

- Average of the industry

- Regression equation method

- Using DDM.

No comments:

Post a Comment