Definition:

Futures are standardized forward contracts traded on an exchange with marked to market features and strangened margin requirement. Futures are considered to be a leveraging tools i.e. instead of buying the stock a trader can buy futures by putting only a fraction of the share price as margin.

Margin requirement

Initial margin, maintenance & variation

Futures vs forwards

Both futures and forwards refer to contractual obligation to buy or to sell an asset at some future date at a pre determined price. However since forwards are OTC & futures are exchange traded there are some differences

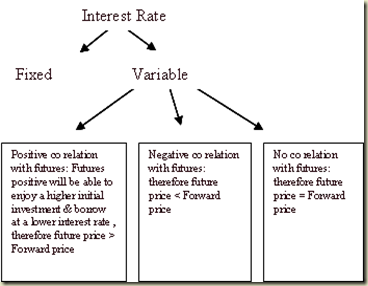

Since futures involve cash inflows & outflows in between there is a time value of money factor which is absent in case of forwards whether future price is absent in the case of forwards whether future price should be higher or lower, then its equivalent forward price is summarized in the chart below.

Open interest

It is the number of future contract that has not yet been squared off. Those who trade in future can take up the following positions

A fresh long & a fresh short position leads to a higher open interest. A fresh long/short combined with a squaring off short/long transaction leaves open interest unchanged finally a squaring off long & squaring off short position leads to decrease in open interest.

As a new future contracts open , fresh position are taken up resulting in higher open interest. However as we approach maturity traders starts squaring up their position such that open interest falls. On the maturity date all outstanding contracts are deemed to have been squared off. i.e. open interest=Zero

| Days | A | B | C | D | Open Interest |

| 1 | 5 | 12 | 7 | 12 | |

| 2 | 20 | 12 | 10 | 42 | 42 |

| 3 | 15 | 5 | 12 | 22 | |

| 4 | 10 | 12 | 22 | 0 |

Traders look at the future price movement together with a change in open interest to judge direction of the price. A change in future price if complement with a higher open interest supports the direction of the change & vice versa.

Therefore

Rise in F & increase in open interest : Bullish; Rise in F & decrease in open interest : Neutral

Fall in F & increase in open interest : Bearish; Rise in F & increase in open interest : Neutral

Relationship between Spot price & future price:

As per the cost of carry model

Future price: Spot price + net cost of carry

Where net cost of carry:

Interest saved + storage cost saved-monetary benefit forgone –convenience yield foregone if net cost of carry is positive/negative, we have future price higher/lower then spot price and the market is set to be in Contango/backwardation. We also define the term called bases, which is the difference between spot price and future price i.e. bases=spot-future. Bases is negative/positive under Contango/backwardation. As we approach maturity bases narrows down to zero.

Mathematisation of the cost of carry model

The cost of carry model when applied to stock, future will capture only the interest and dividend component. The exact procedure of computing future depend s upon nature of information given

Case 1- interest rate is not effective and dividend yield is given.

Case 2 – if interest rates and dividend yield are annualized effectives

Case 3 – if interest rate and dividend yield are continuously compounded

Stock future arbitrage

If the cost of carry model doesn't hold good there should be an arbitrage opportunity

Case I – cash and carry arbitrage.- If actual futures >theoretical futures, futures are relatively overpriced and spot is relatively under-priced.. so we carry out cash and carry arbitrage i.e buy spot and sell future.

Case II – reverse cash and carry arbitrage.- If actual futures < theoretical futures, futures are relatively under priced and spot is relatively over priced.. so we carry out reverse cash and carry arbitrage i.e buy futures and shot sell the stock.

Irrespective of the type of arbitrage, arbitrage profit will be equal to the amount of mis-pricing i.e difference between actual future and theoretical future

Stock index futures

These are futures on a well published benchmark index such as Nifty, Sensex, bank Nifty etc. since the underline is a hypothetical stock index futures are compulsorily cash settled i.e. non deliverable.

Stock index future can be used to speculate on the overall market or a particular sector. Thus if a trader is bullish on banking stock in general he may go long in bank nifty futures say at Rs 1250 with a multiple or lot size of 250 say. If his bullish options turn out to be correct he may able to square of at a higher price Rs 1310 say making a profit of (1310-1250)x 250=Rs 15000

Stock Index Arbitrage

This is normal cash and carry or reverse cash and carry arbitrage.

Limitation of Stock Index Future

- Margin requirement

- Transaction cost

- Dividend risk

- Taxes

- Implementation delays and lack of liquidity

- Tracking error i.e. difference in composition of actual index in the portfolio constructed by the arbitrager

Beta management using Stock index futures

Fund managers may bring about a change in beta of their portfolio by using stock index futures. If they want to increase/decrease they need to buy/sell stock index future.. The no of futures contract to be purchased is given

βT= Target beta (if not given taken as 0)

βP= Existing Beta of the portfolio

βF= Beta Future (not give take as 1)

Currency Futures

a) Pricing and Arbitrage- Currency futures are priced as per IRP.

If IRP dose not hold good there will be an opportunity for covered interest arbitrage.

b) Hedging through currency futures

If a firm has foreign currency payable it is obviously afraid of foreign currency appreciating against its home currency . to hedge the same it should buy future on foreign currency since futures are standerdised it may have to underhedged or overhedged.

On the maturity date of the payable , futures are squared of resulting in a profit /loss. The payable is met by way of spot purchase . We accordingly compute the overall HC outflow.

Similarly foreign currency receivable is hedged by selling future on foreign currency. On the date of receivable futures would be squared off and the receivable will be sold spot. We hence compute HC inflow on maturity.

Future cover is a imperfect hedge as it reduces the uncertainty rgarding the FC outflow /inflow in settling the FC payable /receivable but dose not eliminate.

There are two reasons for imperfection

• Standardization (amount and maturity mismatch)

• Bases risk (spot and future do not move at the same rate).

Speculation using currency futures

No comments:

Post a Comment