Typical capital budgeting involves evaluating a project using the firm existing Kc as the discount rate. However this allowed only if the new project has the same business risk. (i.e. same industry) and same financial risk.( same debt equity ratio) as the existing risk of the firm. More often then not this condition are not satisfied.

- A cement firm may be evaluating a software project – different business risk.

- A cement firm is evaluating a new cement project which would be funded at a higher debt equity ration- Higher financial risk.

In such cases the existing Kc cannot be used and one need to carry out risk analysis. The risk of a project can be viewed in three ways:

- Standalone risk– Risk in isolation

- Firm risk– Firm is a portfolio of projects so what affect would a new project have on the risk of the firm .

- Market risk– CAPM.

Market Risk (CAPM)

As per CAPM only systematic risk captured by beta is relevant. If a firm is unlevered its equity bets reflects only business risk and we tend to call it asset beta. However for a levered firm equity bets reflects business as well as financial risk such that Be>Ba the exact relationship is derived below.

Since debt generates a tax shield tax advantage of debt = PV of perpetual ITS.

| Liabilities | Amount (Rs) | Assets | Amount (Rs) |

| Equity | Be | Asset | BA |

| Debt | Bd | ||

| Total | BL | Total | BA |

So the net debt =D-TD. Hence the relationship between Be and BA is given by Be = BA (1+d/e(1-t)). In the context of capital budgeting this relationship is useful to compute Kc of the new project. Thus consider steel firm with the present debt equity ratio of 1:1. It is evaluating a software project with a DE ratio of 2:1. Obviously the firm present Kc cannot be used as discount rate. The new Kc can be derived as follows:

- Identify proxy firms in the software centre.

- De-leverage their equity beta to get BA

- Take the asset beta for the proposed project as the simple and weighted average of the two forms.

- Re levered the BA with the proposed DE ratio of the new projects to get Be

- Compute Ke and accordingly Kc for the new project.

Calculate the required rate of return on the project from the long term view, given the following information

Equity beta

D/E ratio

ACC cement 1.22 2.00 Ambuja cement 1.50 2.20 Shree cement 1.40 2.10 Assume the risk free rate of return is 12%. Expected rate of return onmarket portfolio is 17%. Tax rate is 46%. The debt equity ratio of the firm is 0.25. Debt interest rate is 14%

Certainty equivalent co efficient method

Certainty equivalent co efficient refers to the fraction of an uncertain CF’s that we require with certainty. So if α = 0.8 it means that we are ready to receive 0.8 with certainty rather then an expected uncertain amount of Re 1. Since investors are risk averse α < 1.

we would be provided with the expected cash flows for a project and corresponding α . We will converse the expected CFs into certain CF’s i.e. αt = CFt and pull them down at RF to compute NPV.

Risk adjusted discount rate method

Risk adjusted discount rate is given by Rk = Rf +N +dk. Where Rf is risk free rate, N = normal r risk premium, dk = differential risk premium for the project. So we need to compute NPV using Rk.

Maximum Risk profile method

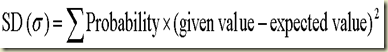

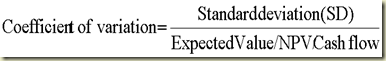

A firm will define its maximum risk profile in terms of :

- Co efficient of variation

- Probability of negative NPV using normal distribution and

- Risk profile table

Sensitivity analysis

Step I: Modeling

Step II: Find out sensitivity of NPV w.r.t. each factor, keeping others constant . The results of sensitivity analysis, can be shown by the two methods

Method I: Find out the break even value for each other & corresponding margin of safety. These factors which have lower MOS are critical. (Use this method if only the expected values of risk factors are given)

Method II: If a range of values for each risk factor is given, you will compute NPV at each values. Those factor/s which can throw NPV is the negative territory are critical

Drawback/limitation: If factors are interdependent it is unrealistic to change one factors keeping other constant.

Scenario analysis

This involves forecasting the values of the risk factors under different scenario subjectively. We then computed expected NPV & SD of NPV. To avoid double counting of risk use Rf as the discounted rate (if available)

Simulation

Step I: Modeling of NPV

Step II: Associating the probability distribution of each risk factor with random variable

Step II: Computing NPV in each run using random No.

Decision tree analysis

No comments:

Post a Comment