Introduction:

Capital budgeting decision are considered to be extremely important of strategic impact, huge amounts involved and irreversibility

A project may be defined as a huge outflow of fund followed by a stream of future inflow.

Steps in capital budgeting

Generation of cash flow

Estimation of discount rate

Selection criteria

Cash flow or accounting profits

Demerits of accounting profit for capital budgeting problems

Affected by non cash items like depreciation

Ignores time value of money

Manipulative

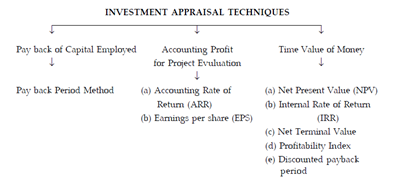

Techniques of Evaluation

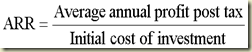

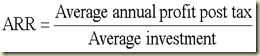

Accounting rate of return (ARR)

Accept/Reject: higher the better

A project involves a capital outlay of Rs 1,00,000. PBDIT for 5 years is expected to be Rs 25,000, Rs 30,000 Rs 40,000 Rs 45,000 & Rs 48,000. Corp[orate tax rate is 50% and depreciation on WDV basis is 40%. Find the AROR of the project. (Assume that the entire profit is withdrawn)

Earnings Per Share (EPS)

EPS is one of the major criterion for capital investment appraisal. The value of a firm is maximised if the market price of equity shares are maximised.

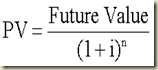

Net present value (NPV)

NPV= PV of inflows-PV of outflows

Important points to consider:

Cash outgo

Cash inflow

Discounting rate

Tax rate

Depreciation

Scrap

Carry forward & set off of losses

Subsidy

Use of probabilities

Overhead allocation

Release of working capital

Earnings

Accept/Reject:

NPV>0: Accept

NPV=0: Indifferent

NPV<0: Reject

Ltd. has two projects under considereation A & B, each costing Rs. 60 lacs.

The projects are mutually exclusive. Life for project A is 4 years & project B is 3 years. Salvage

value NIL for both the projects. Tax Rate 33.99%. Cost of Capital is 15%

Internal rate of return (IRR)

Allows the risk associated with an investment project to be assessed

The IRR is the rate of interest (or discount rate) that makes the net present value = to zero

Accept/Reject:

IRR>cost of capital: Accept

IRR=cost of capital : Indifferent

IRR<cost of capital : Reject

![]() Conflict between NPV and IRR:

Conflict between NPV and IRR:

For a single project NPV and IRR will give the same accept or reject decision i.e. conflict does not exist.

For two mutually exclusive projects there may be conflict between NPV and IRR.

Cause of conflict- the conflict between NPV and IRR arises mainly on account of the difference in reinvestment assumption. NPV assume reinvestment rate of the intermediate cash flows to be Kc while IRR assume reinvestment to be IRR itself.

Situation in which conflict occurs

Size disparity

Cash flow timing disparity

Profitability index (PI)

Allows a comparison of the costs and benefits of different projects to be assessed and thus allow decision making to be carried out

Accept/Reject:

PI>1: Accept

PI=1: Indifferent

PI<1: Reject

S Ltd. has Rs. 10,00,000 allocated for capital budgeting purposes. The following proposals and associated profitability indexes have been determined:

Project

Amount (Rs.)

Profitability Index

1 3,00,000 1.22 2 1,50,000 0.95 3 3,50,000 1.20 4 4,50,000 1.18 5 2,00,000 1.20 6 4,00,000 1.05 Which of the above investments should be undertaken? Assume that projects are indivisible and there is no alternative use of the money allocated for capital budgeting. ) (November 1998)

Pay back period/pay off period/capital recovery period

The length of time taken to repay the initial capital cost

Accept/Reject:

Project with lower pay back period is preferred

![]() One of the limitation of the PBP is that no rate of return can be disclosed. If ROR is required to be computed in the PB situations, compute PB reciprocal as below, which is submitted as ROR:

One of the limitation of the PBP is that no rate of return can be disclosed. If ROR is required to be computed in the PB situations, compute PB reciprocal as below, which is submitted as ROR:

Discounted pay back period

In Traditional Payback period, the time value of money is not considered. Under discounted payback period, the expected future cash flows are discounted by applying the appropriate rate, i.e., the cost of capital.

Summary

| Particulars | NPV | IRR | BCR | Dis PB |

| Interpretation | It is net addition to the wealth of ESH | It is the rate of return on unrecovered Inv bal. | It is the profitability per unit of funds invested | It is the no. of yrs in which the project pay back the amt invested in it considering TV |

| Discount rate | Ke, Kc,K | NA | Ke, Kc,K | Ke, Kc,K |

| Hurdle/cut off | 0 | Discount rate | 1 | subjective |

| Absolute/relative | Absolute | Relative | Relative | NA |

No comments:

Post a Comment