The basic theories underlying the exchange rates –

1. Law of One Price: In competitive markets free of transportation costs barriers to trade, identical products sold in different countries must sell at the same price when the prices are expressed in terms of their same currency.

Purchasing power parity: As inflation forces prices higher in one country but not another country, the exchange rate will change to reflect the change in relative purchasing power of the two currencies.

2. Interest rate effects: If capital is allowed to flow freely, the exchange rates stabilize at a point where equality of interest is established.

Interest rate Parity

Meaning of IRP-It is a relationship between exchange rates and interest rates other factors remaining constant. As per IRP if interest rate in country A are higher than that in country B the currency of country B should be at a forward premium. Thus if interest rate is 12% in India while interest rate is 5 % in Us dollar should be at a forward premium against Re.

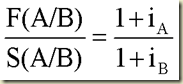

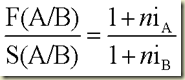

IRP goes on to quantify the forward premium to be equal to the interest rate differential in the approx terms . Thus dollar should be at a forward premium against Re approximately by 12-5=7% and exactly by 7/1.05= 6.67 %.similarly Re should be at a forward discount against dollar approximately by 7% and exactly by 7/1.12 = 6.25 % . I formal terms the IRP equation may be given by

Adding 1 to both sides we have

The ratio of forward to spot rates should be equal to the ratio of interest rate factors. Since forward contracts are available for short term maturities say 1m , 3m, 6m at a periodic adjustment is required . So we have

Rational for IRP

IRP must hold good to prevent covered interest arbitrage .

Cover interest arbitrage involves

i.Borrow one currency (say currency A) and compute currency A outflow on Maturity.

ii.Use the borrowed amount of currency A to buy currency B spot.

iii.Invest currency B and compute currency B receivable on maturity.

iv.Sell currency B receivable forward to get back currency A.

If inflow of currency A from step 4 is greater than the outflow from step 1 there has been a covered interest arbitrage opportunities.

Application of IRP

Forward cover versus money market cover

We had earlier discussed forward cover for the purpose of hedging payable/receivable. However the forward rate might be under priced/over priced. Hence we introduce a new cover called money market cover.

Foreign currency payable

1. Invest the PV of the FC payable.

2. Buy the investment amount spot

3. Borrow home currency and compute FC outflow on maturity.

Foreign Currency receivable

1. Borrow the PV

2. Sell the borrowed amount spot.

3. Invest home currency and compute the HC inflow on maturity.

Purchasing power parity

PPP is a relationship between exchange rate and inflation other factors remaining constant. Inflation erodes the purchasing power of money so a country with higher inflation against another should experience a depreciation of its currency. There are three forms of PPP

- Absolute form

- Relative form

- Expectations form .

Absolute form Of PPP

This is based on law of one price and prevention of commodity arbitrage. Consider a common basket of commodity which sell in India for Rs 900 and in US $ 20. We have $ 20 = Rs 900 or 1 $ =Rs 45. so as per absolute PPP the exchange rate between two currencies should be equal to ratio of the price of common basket of commodities. Now suppose it happens 10% inflation in India and 4 % in UK.

Relative form Of PPP

The relative form relates the past in exchange rate with the levels of inflation to find out the real appreciation depreciation of the currency.

Suppose in the Re & $ example under absolute PPP, $ appreciates only by 2% ( Say) against Re compared to 5.77%. Therefore $ has depreciated in real terms, If $ appreciates by 5.77% exactly there is no real appreciation or depreciation of $. Finally if $ appreciates by 7% ( say), there has been a real appreciate of $.

If Re falls by more/less/equal to 5.45% we say Re has depreciated/appreciated/remain unchanged in real terms

The concept of real appreciation/depreciation is relevant in

a)Determining the competitiveness of a country & export i.e a country’s export will become more competitive, if its H.C depreciates in real terms

b)Determining the real return earned by domestic vs foreign investor

To compute mathematically the real appreciation/depreciation of a currency, let us the following numbers

Spot rate 1year ago (So)= Rs46/$

Spot rate is right now (S1)= Rs51/$

Inflation in india & US last year happened to be 7% & 3% respectively.

Find nominal & real appreciation or depreciation of each currency

Expectation form Of PPP

The expectation form of PP is used to forecast long term exchange rates based on predicted levels of inflation. There could be deviations from PPP in the form of real appreciation or depreciation. Thus if spot rate right now is Rs50/$ & inflation forecast for the next year for India & US are 7% & 3%.

S1 = 50*(1.07)/(1.03) = Rs 51.94

However if Re is expected to appreciate by 1% in real terms: 51.94/1.01 = 51.43

In finding out the cost of ECB, a long term forecast as per PPP is often made.

International Fisher effect (IFE)

Assume that exchange rates will change in direct proportion to relative differences in long term interest rates.

Assumes that long term interest rates capture the market’s expectation for inflation.

Countries with relatively high rates of long term interest rates (i.e., high inflation) will show currency depreciation.

Countries with relatively low rates of long term interest rates (i.e., low inflation) will show currency appreciation.

In equilibrium, the amount of depreciation (or appreciation) will be equal to the long term interest rate differential.

No comments:

Post a Comment