Introduction of dividend

Dividend policy of a firm, affects both the long-term financing and the wealth of shareholders. As a result,the firm’s decision to pay dividends must be reached in such a manner so as to equitably apportion the distributed profits and retained earnings.

Dividend Dates: Declaration, Record, Ex-Dividend & Payment dates

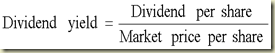

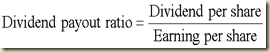

Important formulas :

Theories on dividend policy

The Relevance Concept of Dividends : According to this school of thought, dividends are

relevant and the amount of dividend affects the value of the firm. Walter, Gordon and others propounded that dividend decisions are relevant in influencing the value of the firm. Walter argues that the choices of dividend policies almost and always affect the value of the enterprise.

The Irrelevance Concept of Dividend : The other school of thought propounded by

Modigliani and Miller in 1961. According to MM approach, the dividend policy of a firm is irrelevant and it does not affect the wealth of the shareholders. They argue that the value of the firm depends on the market price of the share; the dividend decision is of no use in determining the value of the firm.

Traditional model by graham dodd

This model is based on bird in hand argument. Investor are risk averse & therefore they prefer certain dividend as compared to uncertain capital gains that may result from RE (retained earnings). So a firm should have 100% payout ratio

The pricing equation is given by

P= m ( D+E/3)

Where m is a certain multiple representing the firms fundamentals

i.e P=m( D + D+r/3)

P=m (4D/3+R/3)

This means that dividend are 4 times the effect on share price as compared to retained earnings

Walter model & Gordon model

Both these models are based on the same assumptions . i.e. retained earnings is the only source of finance for the company. SO if the firm pays dividend it sacrifices the return it could have earned on projects,. Hence the optimum payout ratio of a company should depends on the comparison between ROE & Re

Case I: ROE > Re implied NPV>0 & therefore dividend payout ratio=0

Case II: ROE < Re implied NPV<0 & therefore dividend payout ratio=100%

Case III: ROE = Re implied NPV+0 & therefore dividend policy is irrelevant

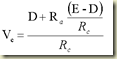

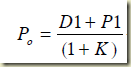

The pricing equation are given by

The earnings per share of a company is Rs. 8 and the rate of capitalization applicable is 10%. The company has before it an option of adopting (i) 50%, (ii) 75%and(iii)100% dividend payout ratio. Compute the market price of the company’s quoted shares as per Walter’s model if it can earn a return of (i) 15%, (ii) 10% and (iii) 5% on its retained earnings.

MM Model

Assuming perfect capital market rational investors no taxes, no transaction cost, no flotation cost, no information asymetry , etc. Dividend policy in real life is irrelevant. The value of a firm depends upon its earning capacity and not on the split up of earnings into dividend and retain earnings.

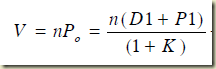

MM advocates the concept of home made dividend i.e. One can achive desired amount of cash dividend by way of buying and selling shares. The pricing equation is given by

Value of the firm

If the firms investment requirements is I and its projected earnings is E the amount it has to raise at the end of year by issuing M shares at price of P1 is given by

MP1= I- (E-ND1)

This gives us ND1 = MP1 – I or

ABC Ltd. belongs to a risk class of which the appropriate capitalization rate is 10%. It currently has 1,00,000 shares selling at Rs. 100 each. The firm is contemplating declaration of a dividend of Rs.6 per share at the end of the current fiscal year which has just begun. Answer the following questions based on Modigliani and Miller Model and assumption of no taxes:

(i) What will be the price of the shares at the end of the year if a dividend is not declared?

(ii) What will be the price if dividend is declared?

(iii) Assuming that the firm pays dividend, has net income of Rs. 10 lakh and new investments of Rs. 20 lakhs during the period, how many new shares must be issued?

Dividend policy in practice

Firms in real life follows the following type of dividend poilcy

i.Constant payout ratio: This will result in uncertain and unstable dividend

ii.Constant DPS : This policy ensures dividend certainity and stability but lacks growth visibility which is also desired by investors.

iii.Constant DPS + growth: In this policy firm announces a minimum amount of DPS which it promises to scale up in case of earnings rising beyond a certain level. This policy is therefore the best possible as it reflects dividend certainty, stability and growth.

iv.Residual Policy: In this policy the dividend are considered to be residue left ( if any) after the firm has funded the equity portion of its investment using net income I.e. Dividend = PAT – Equity investment. This will also result in uncertain and unstable dividend.

Lintner Model on Dividend Stability

This model has two parameter

Target payout ratio(R)

Adjustment rate (C)

The model is given by

The Lintner model shows that the current dividend depends partly on current earnings and partly on previous years dividend. Likewise the dividend for the previous year depends on the earnings of that year and the dividend for the year preceding that year, so on and so forth. Thus as per the Lintner Model, dividends can be described in terms of a weighted average of past earnings

Buy Back

Unlevered buyback: buy back using surplus funds i.e. Dividend vs buy back decision

Levereed buy back: buy back using borrowed funds

Generally as a result of buy back EPS will rise, while pE ratio will fall such that overall impact is uncertain. However if the problem is silent regarding post buy back PE ratio, assume that PE will remain unchanged

1 comment:

Nice! This is interesting. I really like to go through such informative posts. Also, this one is explained very nicely. Will like to share it with my cousin and she explained gratuity rules to me last week in a very simple manner.

Post a Comment