Definitions

Derivatives may be defined as any financial contract or instrument which derives its value from underlying. The underlying can be stock , index, currency commodity , temperature, rainfall & what not.

Types of derivatives

Forward commitments & contingent contract

Types of derivatives

| Over the counter | Exchange traded |

| Customized features | |

| No margin requirement\ | |

| Less regulated | |

| Counter party can default | |

| Lower liquidity | |

| Generally suitable for hedging |

Participants of derivatives

Hedges: They already have an exposure & take a derivative position to offset the exposure

Speculators: They have a price belief & a risk tolerance level. They create a position in the derivative market to make profit from their price belief knowing fully well they can lose

Arbitrageurs: They spot mis-pricing & take long short position with a view to make riskless profits

Pricing of derivatives:

Derivatives are priced on the prevention of arbitrage principle i.e. the price of derivative should be such that no body carry out arbitrage

Financial Swaps

The financial swaps may be defined as a exchange of a stream of cash flow. A financial swap is over the counter (OTC) products & therefore comes in various flavors.

a) Plain vanilla Interest rate swaps:

It is a fixed floating interest rate swaps with a notional principal & netting features

Consider the terms of a financial swap

Notional principal: $100000, maturity 5 years, floating rate LIBOR, fixed rate 10%, and periodicity: annual. A is fixed rate payer & B is the fixed rate receivers

Suppose LIBOR at the beginning of each year over the 5 yeas period turnout to be 11%,13%,9%,8% & 12%.

b) Currency swap

In this case the payments are swapped into two different currencies without netting features. The principal amounts are not notional. There is an actual exchange of principal at the beginning & exchanged at the end of swap

Suppose A & B enters into a currency swap of maturity 5 years in which A receives 10% of ℓ100000 fixed and B pays 10% on $200000 every year (at the initiation of Swap ℓ1=$2)

Step 1: exchange of principal at T=0

Step 2: Annual interest transfer without netting

Step 3: Re exchange of principal at t=5

c) Equity swap:

This involves swapping equity return vs some fixed & floating interest based on notional principal with netting features

D) SWAP quotations

Banks act as market makers and provide bid-ask rate in the swap market. These rates are the fixed quotes vs a floating rate say LIBOR. The fixed quotes are generally expressed as a spread over treasuries.

Thus if a bank quotes 5 yrs fixed to floating swap at 60/90 basis points over treasuries vs LIBOR & 5 yrs treasuries are yielding 7.5%.

The quotes implies that

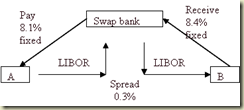

Bank is willing to pay (7.5+0.6) i.e. 8.1% fixed & receive LIBOR

Bank is willing to receive (7.5+0.9) i.e. 8.4% fixed & pay LIBOR

Thus if the bank is luckily stuck equally on both sides of the quote it looks in a spread of 0.3% as shown below.

E) SWAP based on a comparative advantage

No comments:

Post a Comment